THE BASIC THEORY OF FOREX TRADING

1. Understanding forex, forex traders and forex trading.

Forex is a currency exchange one currency with the other. In Indonesian forex is also referred to as Foreign Currency (Forex). In English forex is an abbreviation of two words namely foreign and exchange.

Forex traders are people who do trading in the forex market (forex players).

Forex trading is a sale or purchase transactions conducted on the forex market.

2. Terms to be a forex trader.

To be a forex trader there are several requirements such as capital (in the form of funds), laptop / smartphone, official identity such as ID card, e-mail, mobile phone number and bank savings account. Here are the details of the full requirements:

- Fund.

Funds needed in the form of capital amount of money. Only $10 you can open a forex account in any forex international trading company. However I recommend to start trading with a minimum capital of $100. Why ? Like you bring a car with money $10 and $100. You can still go to drive a car with just carry the $10 money, but imagine if in the middle of the road your car crashed ??? need enough money that much for repair to the workshop ??? bring more money to keep watch, safety be first!

- Laptop / smartphone + internet connection.

It is a tool used for trading and must have internet access. As a beginner I recommend to start using a laptop because it has more features than smartphones (Android, Iphone etc).

- Identity.

Prepare ID cards such as ID, Driver's license, Family Card or other national identities. It is used to register on forex broker (the company where to trade later).

- E-mail and mobile phone number (not home phone).

Used for registration and verification on forex brokers when you register into a real trader forex.

- bank account.

Used for depositing and withdrawing funds to the broker. The identity of the savings account here must the same name as the ID .

3. Benefits of forex trading.

There is no limit of profit in forex trading, the more you profit in transactions the greater the benefits you get. You can profit as much as possible either by buying or selling money on the forex market.

4. The advantages of forex trading.

Forex trading has advantages that can be considered in developing funds for you. Some of the common advantages of forex trading are:

- Cheap.

Although only with little capital you can generate substantial profits. This is because in forex trading there is "LEVERAGE" which allows you to make large transactions with small capital, usually reaches 1: 100 of the capital we have and there are even brokers offering up to 1: 3000.

- Rousing.

The velocity of money that occurs in the forex market is the largest turnover of money in the world that reached 4 trillion US dollars.

- Easy.

Just by understanding the basic concepts of trading you can become a forex trader and generate profits of magnitude with your own techniques and analysis. You do not have to be afraid because you do not understand math, nor do you need to be afraid because you do not understand the economy or even you do not understand about technology. Relax, forex trading is very easy to do even for people who are clueless, you also do not have to understand the science and economics in learning it. Why ??? because everyone's great at affairs the money ^ _ ^.

5. Concepts and terms around forex.

- Forex Broker.

Forex broker is an intermediary company that connects traders (forex traders) to make buying and selling currency on futures exchange (market forex).

- Margin System.

Margin is money used as collateral before making a transaction. A forex trader must have a certain amount of money that has been deposited to the broker as collateral for trading forex.

Trading contract (Unit Lot).

The traded currency is a currency pair, every forex transaction always has a pair of currency pairs (pair). In this case the number of units that have been standardized and used is 1 lot. The standard value of 1 lot is = $ 100,000.

- Currency Pair.

Every currency traded on forex trading is always in pairs (Pair Currency). Pair is symbolized by the letter symbol. Here's an example and how to read it:

GBPUSD = Great Britain Pound against US Dollar.

EURUSD = EURO Against US Dollar.

AUDUSD = Australian Dollar Income US Dollar.

USDJPY = US Dollar Against Japan Yen.

USDIDR = US Dollar Against Indonesia Rupiah.

XAUUSD = Gold Against US Dollar, and so on.

- Leverage.

Leverage is the leverage provided by the broker to increase the ability of the amount of funds that can be transacted from the capital we have.

- Metatrader.

Metatrader is an application that is commonly used forex traders to trade currency on the forex market.

- Two-way opportunity.

In forex online trading there are 1 advantages and differences that are not owned any trade is the existence of two-way opportunity or in English "two ways opportunity". Two directions include buying and selling action where by utilizing these two directions we can reap the benefits of trading. These benefits can we get in the following way:

Buy at a cheap price then sell at high price = Profit (Profit).

Sell at a cheap price then the price falls to be cheaper = Fortunately (Profit)

|

| Two Way Opportunity Concept |

Some of these concepts are things that must be understood by a beginner to be a forex trader. how ... now a little understood is not it?

6. Comparison of ordinary money trading and online forex trading.

Trading ordinary money is a sale and purchase transactions currency one with other currencies. This trade is commonly seen in the money changer.

Example of regular trading (buy money in money changer):

- You have Rp 13,000,000. then you will buy american dollar with all your money, the usd currency at that time is 13 thousand, then got: 13 million divided by 13 thousand = $ 1,000 USD.

- This means at the same time you buy USD And sell the existing IDR at the price of 1 USD = Rp.13.000 and get $ 1,000.

- The next day the rupiah exchange rate becomes USDIDR = 1: 13.100 (1 dollar 14 thousands rupiah) then you sell back all the dollars ($ 1,000) and re-buy the rupiah, and get the money of Rp 13.100.000. This means you buy when the low price sells when the price goes up and earns a profit of Rp 13,100,000 - 13,000,000 = Rp 100,000.

- Online forex trading trading is an online buying and selling transaction by pledging some funds to forex brokers in order to access the forex market.

Examples of trading on forex trading

- You have a fund of Rp. 13,000,000 (13 million).

- You register and open a trading account on a forex broker with 1: 100 leverage.

- You deposit all funds to a forex broker at a usd 1: 13,000 exchange rate.

- Once in the broker's process, you will get a trading account for $ 1,000.

- You have a $ 1000 balance that can be transacted.

- With that capital you can buy or sell the currency pair (pair) to gain profit from trading.

Each forex broker has an application each of which can be used his client to enter this forex market. But in general, the majority of brokers use an application called metatrader 4 which is used to make a sale and purchase of currency. Whenever and wherever if you connect with internet access you can trade for 5 days a week on the forex market

There are several differences that distinguish between direct currency trading transactions (exchange in money changer) and which is done online. The difference is found in the buying and selling mechanism that is done. In online forex trading, there are trading mechanisms that are different from ordinary trades like brokers, margin systems, two-way opportunities and so on.

Not only that, in the presence of leverage, brokers provide more transaction power than our guarantee balance to transact up to $ 100,000 even if we only have $ 1,000? this is an advantage of leverage in forex trading where 1: 100 means your capital strength to trade to reach 100 times of your funds.

7. How to calculate the advantages of online forex trading.

If in ordinary trade we can calculate the profit directly by summing the difference in buying and selling rates, unlike the case with online forex trading where we must calculate the amount of lot in the first calculation. How to calculate the benefits of this law must be understood by beginners so that you better understand the difference of existing trading mechanisms on forex trading than trading directly in money changer. For more details you can understand the examples below along with the terms of existing trading terms.Examples of forex trading.

- You deposit 13 million rupiah to the broker, the exchange rate at that time is 1 $ = RP 1.3000. So the broker will give you MARGIN = (13 million divided by Rp.13.000) ie: $ 1,000 that you can use for trading.

- Once you have a margin of $ 1,000 then the broker will be an intermediary forwarding your request either to buy or sell an online currency pair using a laptop or smartphone connected to the internet from Monday to Friday.

- Then you plan to buy a Currency Pair with STANDART CONTRACT, ie buy GBPUSD of 1 Lot. At that time the GBPUSD exchange rate is 1.3100 which means 1 GBP can be redeemed at 1.3100 USD (1 app. 1.3100).

- By using METATRADER application you buy 1 lot GBPUSD at 1.3100 price exchange. A few hours later the GBPUSD exchange rate has changed to 1.3150 and then you close the buy position. How much profit do you get?

The calculations are:

- Buy 1 lot at 1.3100 and close at 1.3150.

- Then in accordance with the formula OPPORTUNITIES 2 DIRECTIONS where buy at a cheap price then sell at expensive price = Fortunately.

- So the benefits you get are:

- Profit = Number of Lot of transactions x (open price order increment [buy / sell] - close order)

- Profit = 1 Lot x (1.3150 minus 1.3100)

- Profit = 1 Lot x (0.0050)

- Profit = $ 100,000 x 0.0050

- Profit = $ 500

how can a $ 1,000 capital gain $ 500 in just a few hours? How can such profits be possible in online forex trading ??? Let's compare the trading profits in money changer and online forex trading.

8. Comparison of profits between buying currency in money changer and online forex trading.

Mathematically on a money trade in money changer if you have $ 1,000 and use it to buy GBP at a rate of GBPUSD of 1.3100 then you will only get GBP of £ 763.35. Do you understand where the figures came from £ 763.35? If you have not, followed this how to calculate it.How much is earned when redeeming $ 1000 to GBP?

Exchange Rate GBPUSD = 1.3100

This means £ 1 GBP = 1.3100 USD

The question is $ 1000 = How much GBP. ?

Total GBP earned = Amount of fund x (1: 1,3100)

Total GBP earned = $ 1,000 x (1: 1,3100)

Total GBP gained = 1000 x 0.763.35

Total GBP gained = £ 763.35 (GBP)

So with $ 1,000 USD you can trade it for £ 763.35 Pound Sterling (GBP)

When you have as much as $ 1,000 and convert it to a money changer then you will get GBP £ 763.35.

After a few hours the GBPUSD exchange rate changes to 1.3150 and then you swap back the GBP to USD $ in the money changer. Then the profit you get is $ 3.8. Do you understand where $ 3.8 comes from? If you have not followed this how to calculate it.

Profit = (amount of GBP owned) x (exchange rate has changed) - (initial capital)

Profit = £ 763.35 x (1,3150) - ($ 1,000)

Profit = $ 1003.80 - $ 1,000

Profit = $ 3.8

Now you try to compare between trading using margin system and regular trading in the money changer. The profit earned is $ 500 to $ 3.8. far is not it ???

9. Functions and benefits of lot and leverage.

Logically, for $ 1,000 you can only trade it for £ 763.35. In the example above when the exchange rate has changed and exchange exchange (GBP) back into US Dollar (USD) will be earned $ 3.8. Then, why in online forex trading profits earned $ 500 while the capital and exchange rate used is the same?At point 5 the concept concepts and basic terms about forex trading. You have been taught the amount of Lot, the margin system and also the leverge. Well, these three things that affect why the profits derived from online forex trading is greater than selling and buying directly in the money changer. Below I will explain the function and role of Lot, and the Leverage.

LOT

If we buy mineral water then the unit is 1 bottle. if we buy oil at the pump then the unit is liter. and if we buy cigarettes the unit is 1 pack of cigarettes. Well on forex trading units used are lots. Above has been explained that the standard value of 1 lot is 100,000.

Leverage

A big question mark first when the author knows forex is why only with a capital of $ 1,000 we can afford to buy $ 100,000. With the help of leverage you can buy currency with a larger amount of capital you have. Leverage is a loan fund provided by a broker to make transactions larger than the ability of funds you have. If the forex broker provides 1: 100 leverage that means we have the ability 100 times greater than our funds to make trading.

An example is if we have a balance of $ 1,000 on a broker that gives leverage of 1: 100 then that means the broker gives us the authority to make transactions of $ 1,000 x 100 = $ 100,000. So with this answered already why with a $ 1,000 margin we can make purchases of currency by 1 lot.

Back to the title of this article, I will complete its mission to teach you to be a forex trader in just 1 hour with theory and practice. Maybe you some start to feel bored with the above theory. Relax .. I have completed all the theories that beginners need. In sub sub next material we will do the practice of online trading simulation on demo account by using metatrader 4 application. With this practice of using metatrader 4 then we will more easily understand the mechanism of trading as well as do not have to bother bother to calculate the amount of profit. All transaction activity logs, as well as profits will be instantly visible in real time.

FOREX TRADING PRACTICE.

There are various tools used by brokers as online forex trading medium, but in general the majority of brokers use an application called metatrader as trading medium used. Metatrader itself is a trading application created by metaquotes corp and has a feature complete enough to make it easier for traders in trading online. This application we will use to simulate forex trading online.

10. What is a meta trader?

Metatrader or commonly called MT4 is a medium used to perform forex trading applications that can be installed on a laptop or smartphone. By using this MT4 application we can do online forex trading simulation. This application can be downloaded for free here:Download the metatrader 4 app for pc / laptop.

Download the metatrader app for android.

Download the MT4 app for Iphone.

11. How to install metatrader 4 on the computer.

First, Download the Metatrader 4 application above, Click 2 Times mt4 setup file, it will exit the display as shown below. Check Yes, I agree with all terms of license agreement and select next. |

| How to Install Metatrader 4 part 1 |

- Wait until the download is complete then click finish.

|

| How to Install Metatrader 4 part 2 |

- Metatrader 4 is ready for use.

12. How to open a demo trading account

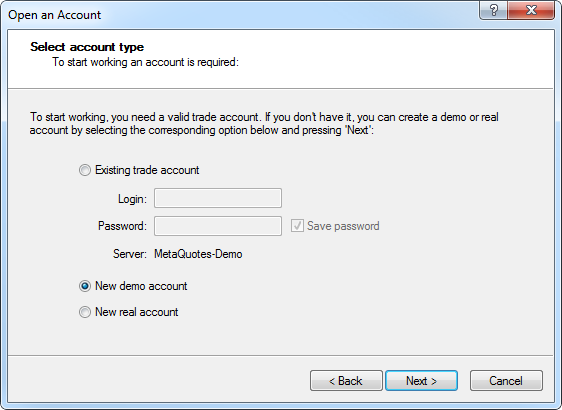

Open the metatrader 4 app.

Type "metaquote" without the quotation marks in the fields provided and click scan.

|

| How to Open a Trading Demo Account Part 1 |

- Click the metaquotes demo then click next.

|

| How to Open a Trading Demo Account Part 3 |

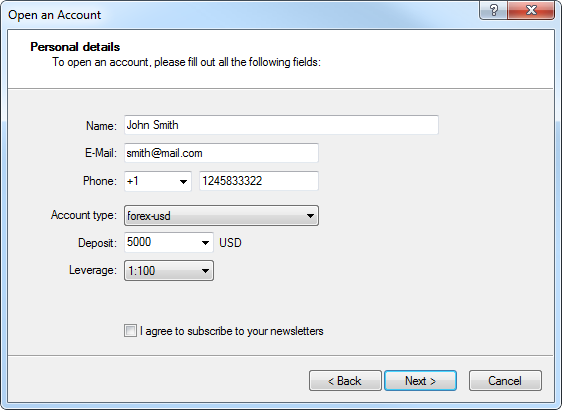

- Type in your name, email and mobile phone number. Then click Next. *** You can write any email & hp numbers arbitrarily but the column must be filled.

|

| How to Open a Trading Demo Account Part 4 |

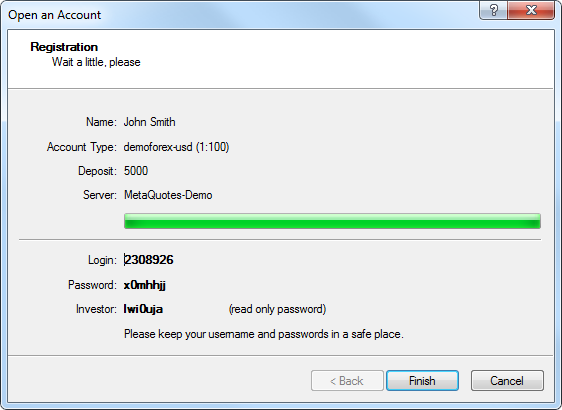

- Record and save your login and password information then click finish.

|

| How to Open a Trading Demo Account Part 4 |

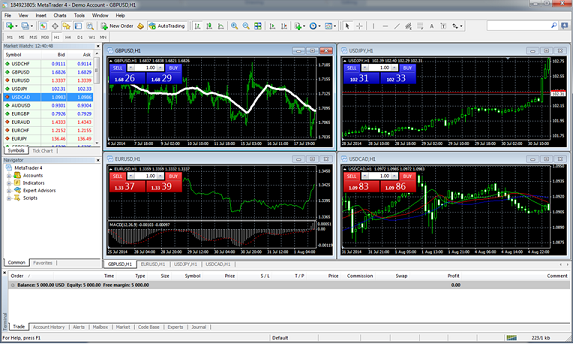

- The metatrader 4 application is ready for use.

|

| How to Open a Trading Demo Account Part 5 |

Once you have downloaded the metatrader application and follow the instructions on how to install it. Metatrader application is ready to be used for the simulation of forex trading, the next step you need to know is how to use the application. Perhaps some of the curious start is not with graphic images and buttons unknown function and how to use them.

Well now I will teach you the working system of this application, empty all your thoughts about all the buttons (do not be considered dizzy others) and JUST FOLLOW INSTRUCTION I GIVE.

Actually there are only two important things you need to know:

1. How to order (sell or buy)

2. How to profit from forex trading.

Are you ready to do this online trading forex trading simulation?

13. How to buy and sell (sell and sell) on metatrader 4.

- Close 3 window graphs like the image below and leave only 1 window.

|

| How to Buy and Sell Forex part 1 |

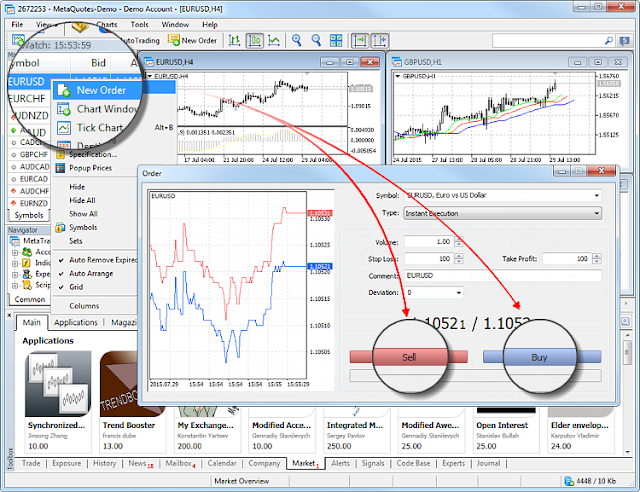

- Press the tools button on the top left and then select new order or you can do it by pressing the "F9" key on the keyboard.

|

| How to buy and sell forex part 2. |

There are 2 buttons that are buy and sell, Buy button is used to buy blue and red Sell button is used to sell. Up here we have learned how to do buy and sell order in metatrader 4. Easy not, to do open order trading we only need to know how to do buy and sell on metatrader.

14. How to benefit from forex trading.

Well now how to get us to benefit from this online trading simulation ??? What we have to do to make a profit. As has been explained in the basic concept above that there are two opportunities to gain profit is the opportunity to gain profit from the position of buy and also from the position sell.

1. Gain profit from buy position that if we do buy order and price chart move up then we will get profit.

2. Gain profit from sell position that if we do sell order and price chart move down then we will get profit.

15. Forex Trading Simulation with demo account.

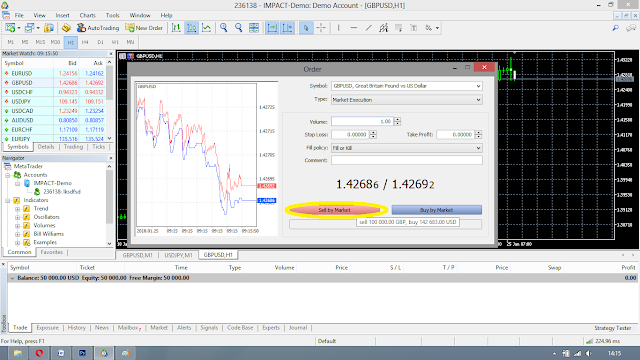

Choose the currency you want to trade as shown below. Click the file then select new chart then choose GBPUSD. Here I will provide trading example using GBPUSD pair.

|

| Forex Trading Part Simulation 1 |

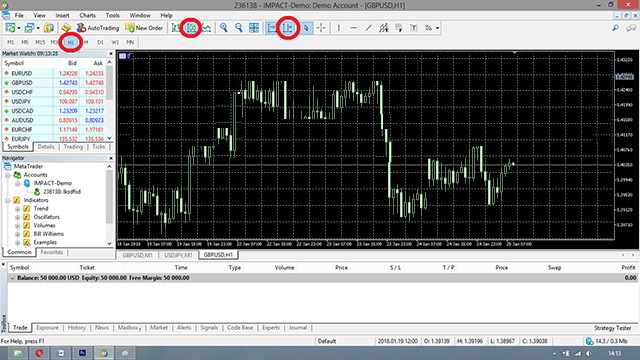

- Then it will exit display like this then click all circled buttons.

|

| 3rd Forex Trading Simulation |

- After that will be out notification that your order has been successful.

|

| Forex Trading Simulation Part 4 |

- After almost 1 hour GBPUSD pair has moved as much as 10.3 pips (103 pipette). Because the direction of the chart moves down and we take the previous sell position, then we have managed to get profit from forex trading. here's how to see how much profit we get at once I will explain how the calculation.

- Here's how to calculate how much profit we get and how to calculate it.

|

| Forex Trading Part Simulation 6 |

In the simulations done above, seen gains obtained for $ 103. Order sell made by 1 Lot managed to get profit because the price move in accordance with the analysis is down to the bottom. It's easier to calculate the benefits with practice than the theory is not it?

After studying:

- The basic concept of forex trading

- How to use metatrader (buy and sell pair)

- And how to get profit on forex trading and calculation.

Surely you will think how the heck how to analyze whether the chart will move up or move down. This will be understood gradually based on your experience flying hours in trading.

Briefly I will explain 2 ways to analyze market price movements that is with technical analysis and fundamental analysis so you can know the direction of movement of currency value. Armed with this analysis you will be ready to face the real forex market when you open a forex trading account in the future.

16. Learn technical analysis.

Technical analysis is one way to analyze currency price movements in the forex market. This technical analysis uses the history of movement in the past to analyze future price movements. The technicalists (traders who use technical analysis) have the slogan "History Repeat It Self" which means that past price movements will be repeated in the future.

This time I will teach you to use one technical indicator that has been tested by many people able to make profit on forex trading that is technical analysis using RSI indicator. Then how does the system work of this indicator as a signal for you to open a buy or sell position?

Relative Strength Index (RSI) indicator is one of the indicators of oscillator which is considered quite reliable. Traditionally, the RSI indicator is used to detect overbought and oversold levels, as well as divergences against price movements. But more than that, in fact this indicator can also be used to detect the direction of price movements in trending conditions with a combination of pattern of price movement (pattern), trend line, and indicator Moving Average. These ways are often applied by traders to get the right entry level, or to confirm trend indicators.

|

| Traditional Use of RSI Indicators |

Traditional Use of RSI Indicators

The first trader who first recognizes this indicator will tend to use the basic rule as an oscillator. If the RSI line is below level 30 and moving upwards, there is an oversold condition signaled to open a buy position. Conversely, if the RSI line is above the 70 level and moving downwards, it means that the overbought market condition indicates a signal to sell.

17. Learn fundamental analysis.

Fundamental analysis is an analysis that uses economic news related news of a country's economy that impact on the movement of currency. This analysis has a very wide coverage and as a beginner you do not need to know all sorts of aspects of the economy in it. Why is that ? because this will you learn at the higher level of learning forex that is on forex trading curriculum forward. In this fast way of learning forex I will just give examples of news and how to analyze it for easy to understand.

Sample News: When you read the news or watch a television show, there is news that there has been a tsunami in the UK, All the ports and settlements along the coast have been severely damaged. There were many injured locals and the hospital was full of incidents. At the same time there was also news that the singer of some one like you song "adele" who came from England moved home to Indonesia precisely next to my house.

What is the effect of fundamental news on the movement of the pound sterling currency?

The effect is that pound sterling will weaken, one of them is due to the export and import through the sea roads are obstacles so the economy in the UK becomes disrupted. As a result of this, the exchange rate of GBP currency will fall and as a forex trader we will take a position of selling GBP to benefit from the decline in currency value due to this news.

Continue to what effect adele moved home to Indonesia precisely beside my house ???

The effect is I will often hear adele singing loudly until my house so I do not focus on trading. This will cause my economy also disturbed hahahahahaaa .....

Fundamentally, Not only natural disasters will affect the exchange rate of a country's currency. There are many other trigger triggers that can also affect price movements such as interest rates, unemployment rate, a country's labor wage, mining production levels, plantations, agriculture and many other fundamental factors.

If you understand and are able to analyze this, then with forex trading you can channel your talents and abilities in observing the economy of a country and seek opportunities to achieve profits of magnitude.

19. Conclusions

FOREX is a currency trading where there is an exchange rate. To be a FOREX TRADER required some requirements include capital in the form of funds (money), laptop / smartphone, official identity such as ID cards, e-mail, mobile phone number and bank savings account. This is required to register to BROKER so that we can have ACCOUNTS to conduct online forex transactions (TRADING FOREX ONLINE).

Before we can do real forex online trading first we must deposit funds to the broker as a guarantee fund (MARGIN) for SELL BUY TRADE CURRENCY deals using METATRADER application. There are two ways of analyzing price movements, the first being technical and secondly fundamental. With an indicator of the analysis, we will know when it's time to buy and sell a currency pair.

When we buy a pair then the price goes up then we will get a profit, as well as when we sell a pair then the price decreased then we will also benefit. The profit is obtained from the difference between the selling price and the purchase price of the order opened until the order is closed.Okay .. hopefully you can understand this article and I think after studying and practicing the tutorial above, you will be able to become a forex trader within one hour. Once you learn to use a demo account and are able to analyze well and have sufficient requirements to become a forex trader then be prepared to plunge into REAL TRADING by using REAL ACCOUNTS.

As the saying goes, ala can be because ordinary. Likewise on forex trading, by getting used to trading you will be able to get profit as much as possible consistently according to your level of ability. Hopefully this Tutorial is useful for beginners.

Berkomentar u/ kritik & saran yg baik, demi kemajuan bersama,,